This includes treadmills weights and more Harvard Health Publishing. Get started with Peloton.

Is Peloton Worth It My Peloton Bike Review 2021 Paisley Sparrow Healthy Curves Biking Workout At Home Workouts

There are multiple ways you can spend from your HSA.

Can i use my hsa card to pay for peloton. The primary purpose of an HSA is to create a fund you can use to cover your deductible copays and coinsurance in the event that you incur major medical expenses. You cant use it to pay for just anything though so take the time to understand what exactly your HSA can cover. Commitment and prepaid periods.

Pelotons use of your information is governed by our privacy policy. My insurer andor employer does not offer reimbursement. Pick a payment plan.

You must promptly notify us or our payment processor if your payment method is canceled eg for loss or theft or if you become aware of a potential breach of security such as the unauthorized disclosure or use of your username or password. You can use your HSA account for a lot more than you think. They even have a quote on the website from a Peloton user that says I financed the whole thing.

The short answer is no. Exercise equipment are any machines or equipment used for physical exercise. This is the internets first and only complete list of both HSA-eligible and ineligible expenses.

FSA Spending on Peloton Bike for an effective 25 off. A Quick HSA Coverage Overview. Please note that this site is an educational reference onlynot all.

By the time we get to the health savings account HSA. Bookmark this page so you can always spend your HSA funds in the smartest way possible. In most cases you cannot use a health savings account HSA to purchase an electric bike or really any sports or recreational equipment.

But there is a longer answer which could end in yes. Complete list of eligible HSA expenses for 2021. Your spouse regardless of whether you file taxes jointly or separately Any dependents you claim on your tax return your children or a q u alifying relative dependent and any children who are claimed on your ex-spouse.

Select a flexible monthly financing option from 12 24 39 or 43 months. According to the Peloton website this financing option is 0 down and simply requires a quick application that will not affect your credit score as opposed to say applying for a credit card. Use your Fidelity HSA.

Here it is - the most-comprehensive eligibility list available on the web. Exercise equipment must be used to treat a specific medical condition in order to be considered eligible for reimbursement under a consumer-directed health care account. Sure you can swipe your HSA card anywhere for anything but you lose the tax benefit unless it is for qualified medical expenses.

When you your spouse and your dependents have qualified medical expenses that arent covered by your health care plan you can use your HSA money tax-free 1 to pay for them. HSA - You can use your HSA to pay for eligible health care dental and vision expenses for yourself your spouse or eligible dependents children siblings parents and others who are considered an exemption under Section 152 of the tax code. From A to Z items and services deemed eligible for tax-free spending with your Flexible Spending Account FSA Health Savings Account HSA Health Reimbursement Arrangement HRA and more will be here complete with details and requirements.

Most of us probably zone out during our employers health benefits presentation. Americans can use their health savings account to purchase exercise equipment like a bicycle if they have a diagnosed medical condition and receive a Letter of Medical Necessity from their doctor said Shobin Uralil founder and COO of Lively a customer-centric HSA. Start by choosing a package add on any accessories then choose Pay Over Time at checkout.

In Publication 969 the IRS clarifies that you can withdraw tax-free money from your HSA to pay for qualified medical expenses for. If you would like to reach out to your insurer andor employer to explain the benefits of Peloton weve created a downloadable PDF download here for you to useMy insurer andor employer offer some form of fitness reimbursement. The IRS states that any expense eligible for reimbursement through an FSA HSA or HRA must relate to the costs of diagnosis cure mitigation or treatment of disease and the costs for treatments affecting any part or function of the body As such exercise equipment like treadmills can certainly fall under this definition but a.

Please talk to your tax advisor first and dont take Reddits word for it that youll be fine because the IRS wont know. The monthly expense of her current workout classes is why my wife has had her eye on a Peloton bike for a while. For those without a bike who are balking at price here is an idea that might help reduce the real cost by using FSA funds to purchase.

Options may vary by Peloton product. Peloton All-Access Membership separate. You can pay 30 for a 45-minute class which really adds up each month.

A Peloton is an Internet-connected indoor cycling bike which streams live and recorded classes. I have been lurking for a while and wanted to start conditioning to lose weight and overall health.

If You Re A Healthcare Worker You Need To Know About 2 Peloton Discounts

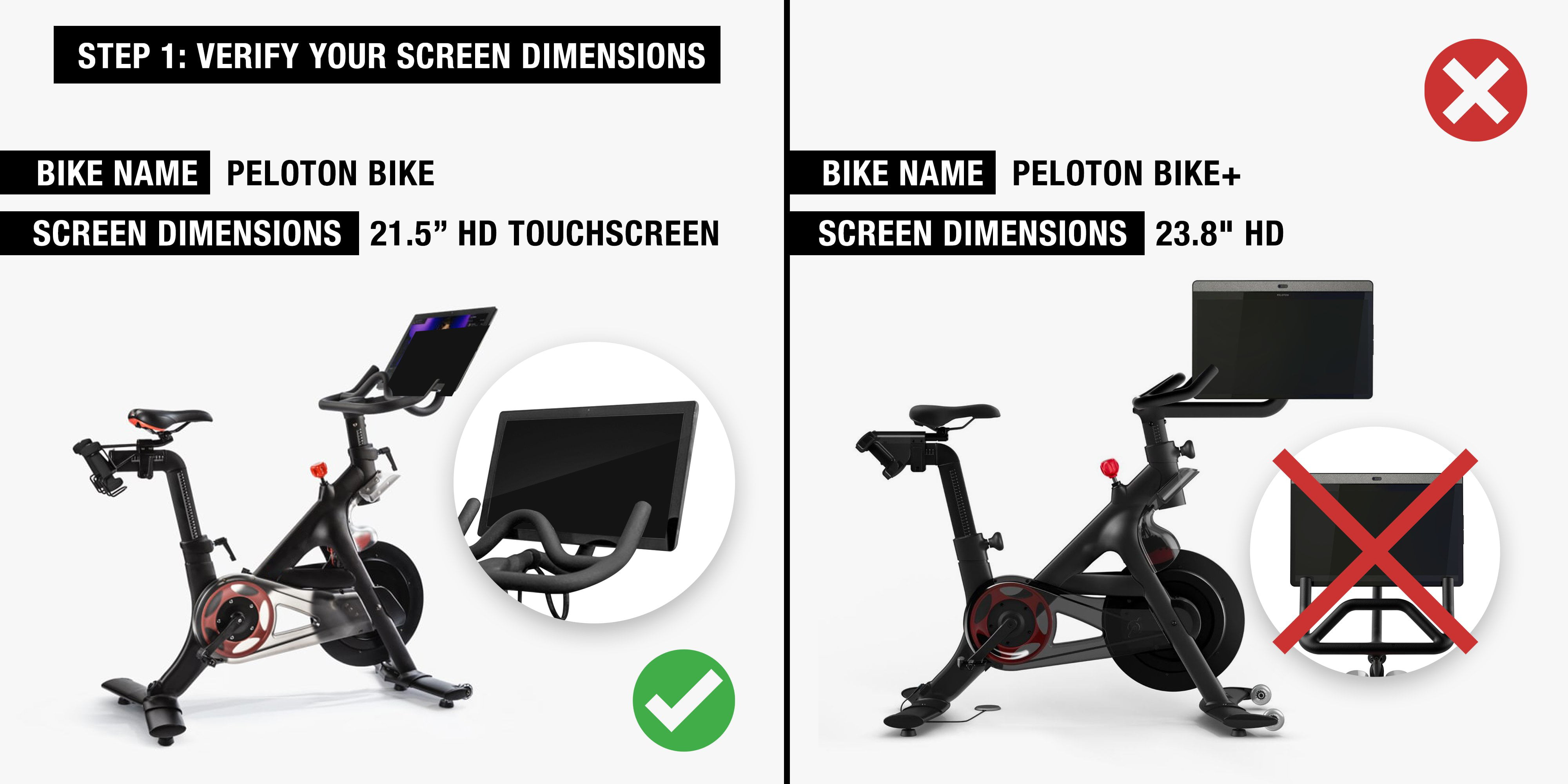

Neoprene Screen Cover Designed For Protecting The Screen Of The Peloton Bicycle Not Peloton Bike Walmart Com Walmart Com

Tidak ada komentar